2 shareholder health insurance k-1

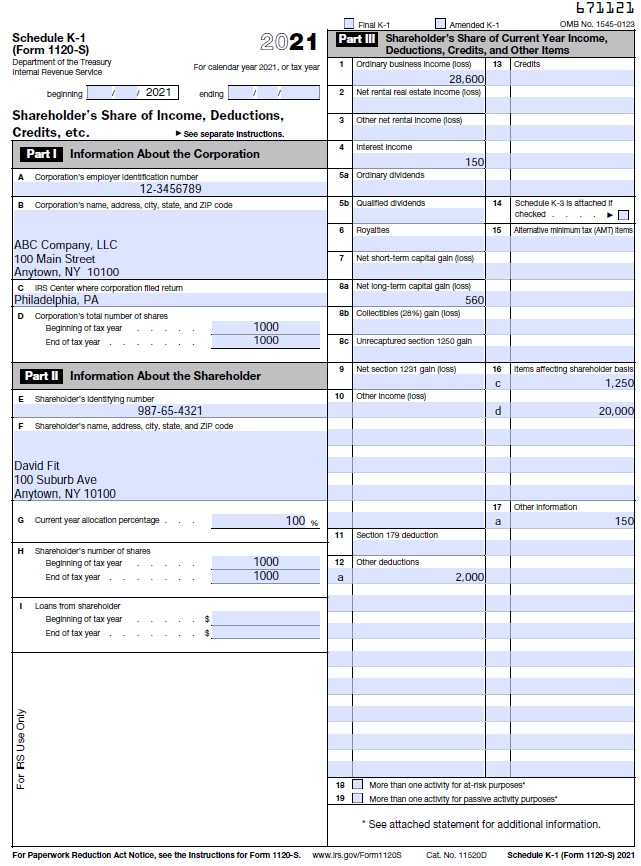

Payments of the health and accident insurance premiums on behalf of the shareholder may be further identified in Box 14 Other of the Form W-2. The Schedule K-1 541 for the income and deductions for the IRC Section 1361d assets should include all of the trusts items of income and deductions from such assets.

A Beginner S Guide To S Corp Health Insurance The Blueprint

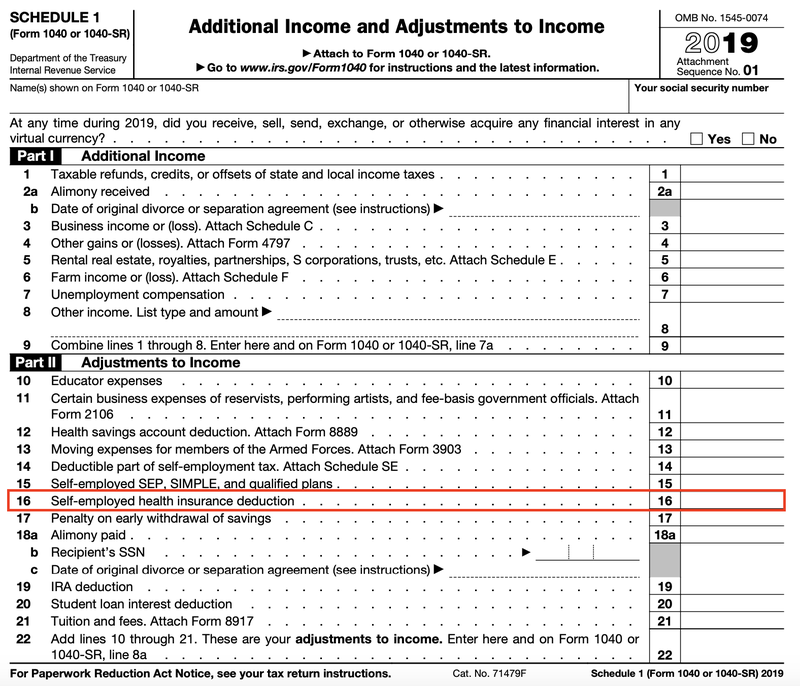

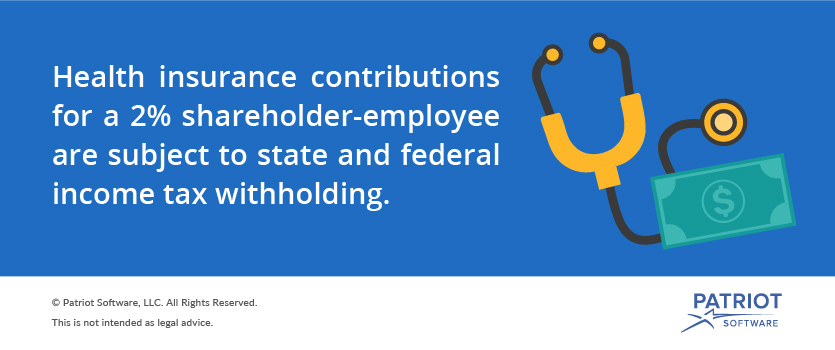

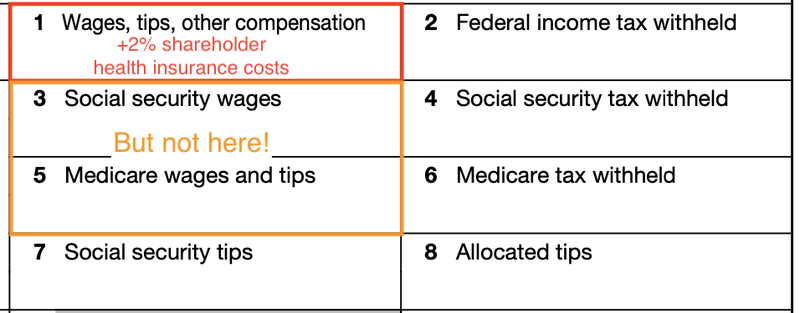

The cost of health insurance premiums paid by the S corporation for a 2 shareholder is included in the shareholders W-2 as Box 1 taxable income.

. If the S corporation pays them they must be reported on the shareholder-employees Form W-2 as. After-tax medical expenses can be deducted if you itemize your tax return however you can only deduct the amount of your total medical expenses that exceed 10 of your adjusted gross income. 9 Schedule K-1 Form 1120S Shareholders Share of Income Review Line 16d for a distribution Only add back the eligible Other deductions such as.

If the estate or trust does not use an official FTB Schedule K-1 541 or a. Premiums for health insurance paid by a partnership on behalf of a partner for services as a partner are treated as guaranteed payments. The aggregate amount of losses taken into account by a shareholder is limited to the sum of the adjusted basis of the shareholders stock for the tax year and the shareholders adjusted basis of any indebtedness of the corporation to the shareholder figured after increases for items of income and decreases for non-dividend distributions.

Schedule K-1 Form 1120S and Form 1099 should not be used as an alternative to the Form W-2 to report this additional compensation. The amount is subject to federal income tax withholding. This means that you are paying for your medical insurance before any of the federal state and other taxes are deducted.

Follow specific investor guidelines. Substitute Schedule K-1 541. A shareholder may not claim loss and.

The partnership can deduct the payments as a business expense and the partner must include them in gross income. Write QSST across the top of the Schedule K-1 541. Medical insurance premiums are deducted from your pre-tax pay.

There is no definition of a class. Similar to the rules for a partnership either the shareholder-employee or the S corporation can pay the premiums. Shareholder-employees who own more than 2 of the company may have a health insurance policy in their names or the name of the S corporation.

Self-employed health insurance premiums. It is not subject to FICA and FUTA taxes if the payments are made under a plan for employees generally or for a class or classes of employees. Amortization or Casualty Loss.

Payment or reimbursement as wages on the 2percent shareholders Form W-2. May not be required if there is evidence these roll over regularly it is verified to be a line of credit or if the business has sufficient assets to. However if the partnership accounts for insurance paid for a partner as a.

A Beginner S Guide To S Corp Health Insurance The Blueprint

.jpg)

How To Deduct Your Health Insurance As A 2 Shareholder Hourly Inc

What Is 2 Shareholder Health Insurance Definition Benefits

Affordable Care Act Form 1095 A S Corp K 1

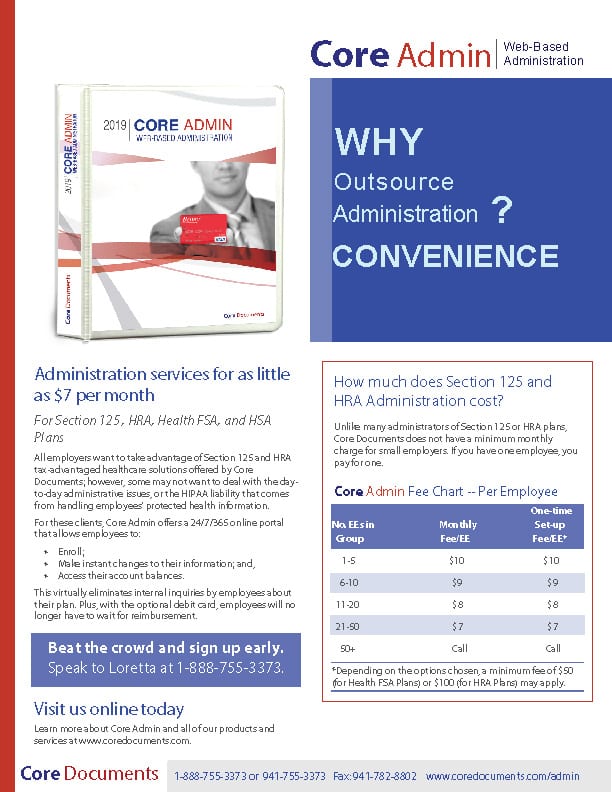

Health Insurance For S Corporation 2 Shareholders Core Documents

A Beginner S Guide To S Corp Health Insurance The Blueprint

How To File S Corp Taxes Maximize Deductions White Coat Investor